Why Do Renters Have to Save More?

Learn all about Medicare basics in this informative and insightful article.

Learn about the dangers of internet fraud with this highly educational and fun “pulp” comic.

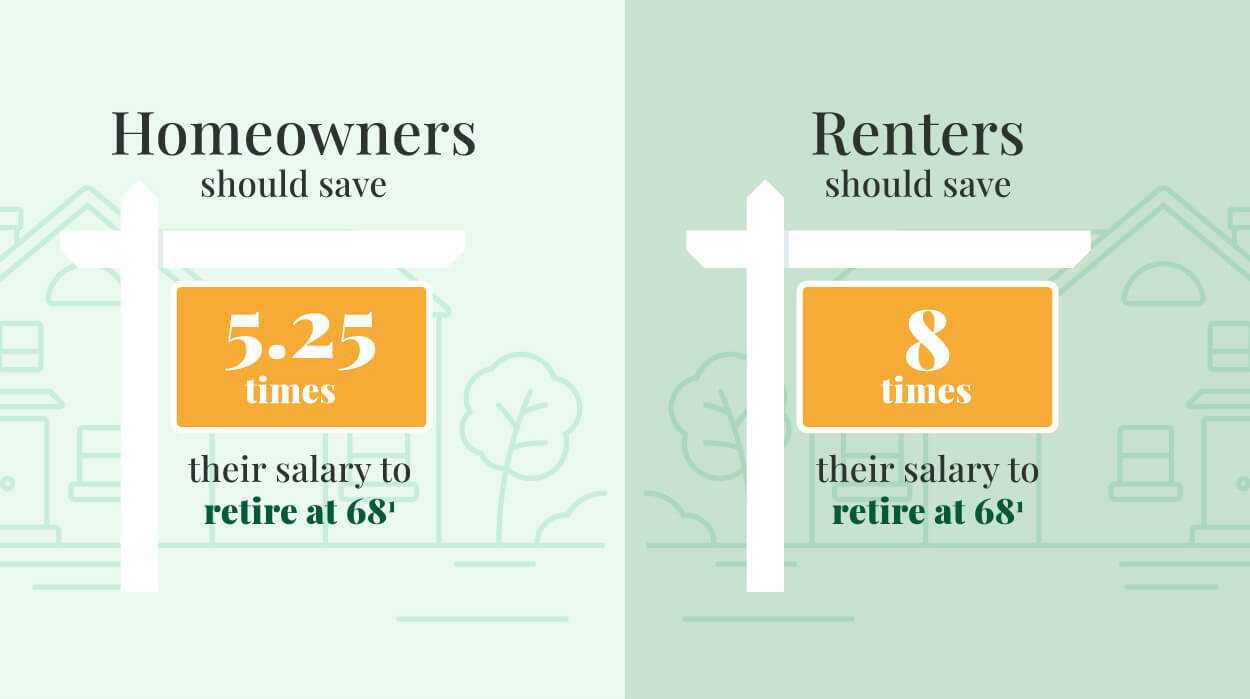

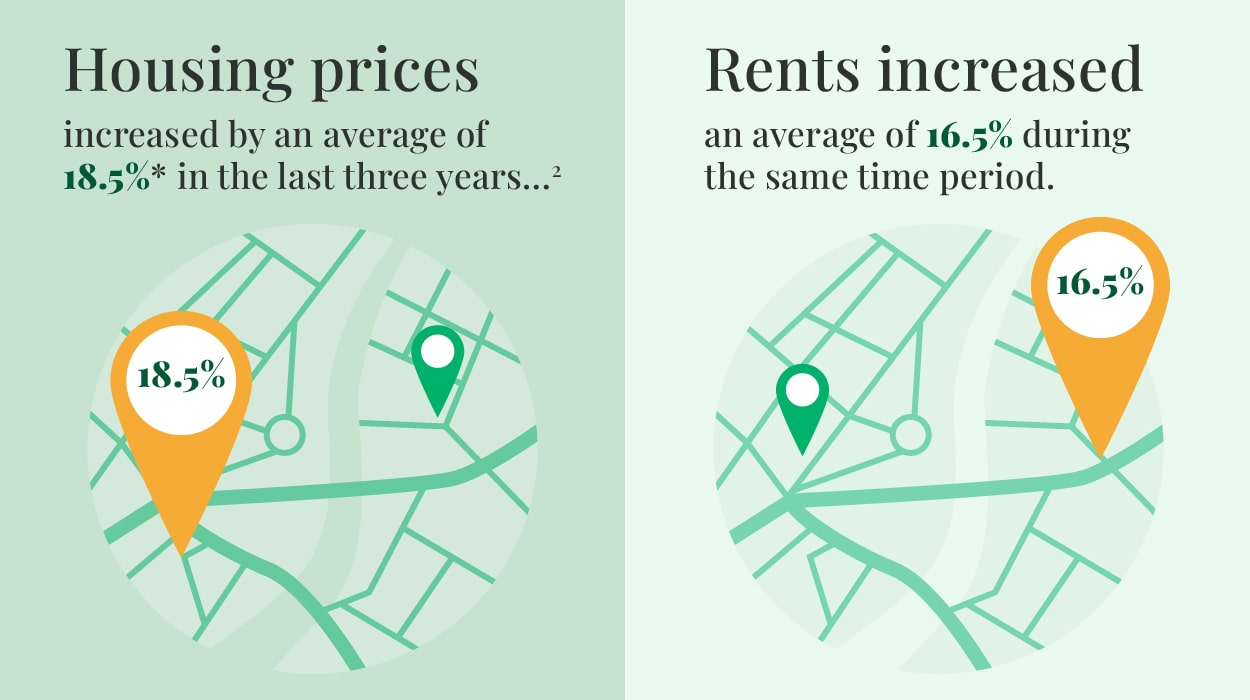

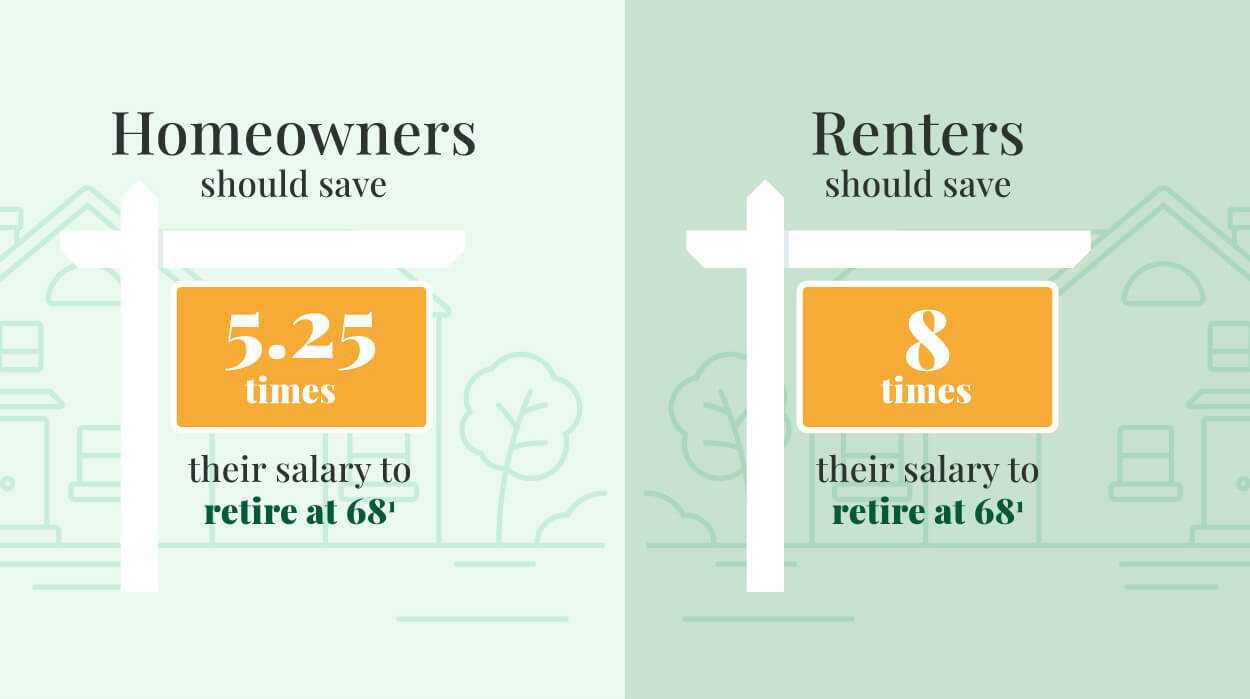

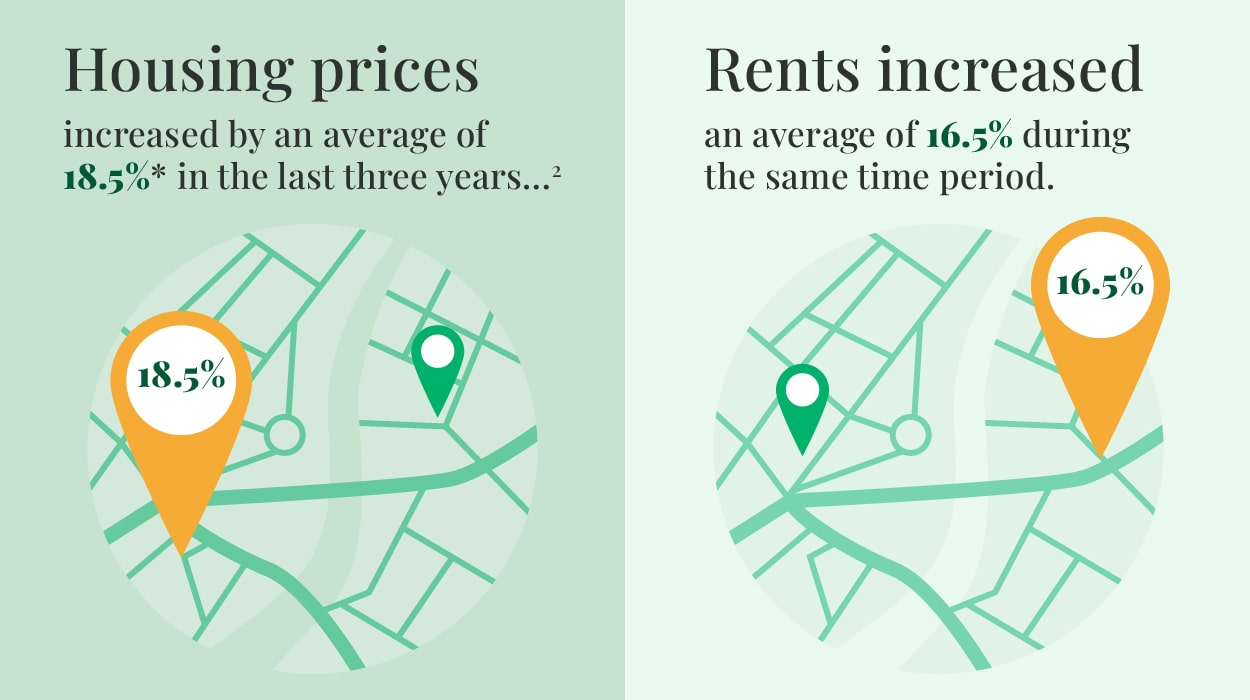

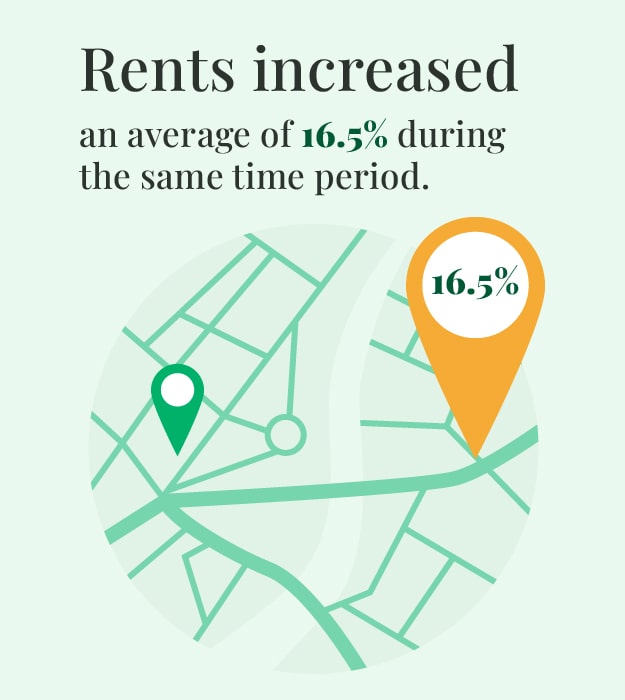

The decision whether to buy or rent a home may have long-term implications.

Net Unrealized Appreciation and how it affects tax responsibilities.

How literate are you when it comes to your finances? Brush up with these five basics.

A look at what you need to think about when buying a home.

Use this calculator to compare the future value of investments with different tax consequences.

Estimate the potential impact taxes and inflation can have on the purchasing power of an investment.

Determine your potential long-term care needs and how long your current assets might last.

Tulips were the first, but they won’t be the last. What forms a “bubble” and what causes them to burst?

Peer-to-peer payment apps are one of the newest ways to send money.

A financial professional is an invaluable resource to help you untangle the complexities of whatever life throws at you.